Source: The Economist AMP1

2023 has been quite a rollercoaster when it comes to investing.

There has been a lot to be worried about and this has trickled down into the investment market – including superannuation investments!

2022 was the first-year things “went back to normal” after COVID.Unfortunately, it was not going to be sunshine and rainbows as everyone initially had hoped for. We would soon see record-high inflation knocking at the door –followed by some aggressive interest rate hikes in the attempt to control inflation.

These hikes have hurt everyone. In 2023 we have continued to see the same tightening and cost of living pressures on consumers. In the midst, we have also been dealing with the Ukraine-Russian war, and more recently the Israeli conflicts in Gaza, as well as varying geopolitical tensions and supply chain disruption.

Across the world, the economic pathway is far from certain.

There will be a few things we will be watching for in 2024.

Recession Risk: Economic growth and inflation are expected to slow in 2024. We are anticipating a “soft landing” recession. This will see inflation declining back to normal levels in 2024 in the US, with GDP remaining medium-strong in 2024 & 2025. Because Australia trails behind the US by around 3-6 months, the risk of recession for Aussies is slightly higher. Australians carry high levels of household debt; and the interest rate rises we have seen have put increased pressure on consumer spending due to decreasing savings buffers and mortgage repayments phenomenally high.

Interest Rates: The general consensus is that rates will fall. However, the speed at which they fall is yet to be determined. It is possible rates will start to fall in most countries whilst Australia’s interest rates are predicted by economists to stay higher for longer – with some small changes anticipated mid-late 2024. With interest rate changes, it is hard to know whether the true economic impact of global monetary tightening has been truly felt in the economy and this is a space to watch.

Ongoing War and Energy Prices: A major escalation in the Israeli conflict could increase the price of oil. This has the potential to cause a global energy shock, impacting the efforts of the last 12 months to bring inflation down. There is also the very real risk of an overlap in energy market disruptions already caused by the Russia’s and Ukraine war.

China’s economic Growth: A stagnating or collapsing Chinese economy will cause rapid reshoring and global equity volatility, and heightening recession risks for China’s trading partners. We have already seen a shift in global supply chains away from China following the 2020 COVID outbreak, and given their GPD growth has been somewhat stagnant since the early 2000’s, economic weakness presents a challenge in 2024. However it may present as an opportunity to invest in China further given the “buy-in” price is lower.

In summary, 2024 outlook is looking like:

- Equity markets are likely to remain volatile in the short-term but would provide reasonable returns in the longer returns as inflation and interest rate pressures relax.

- Global growth will slow in 2024

- Recession risk remains high

- Australia, we may not meet our target 3% inflation until mid-end 2024.

- Interest rate rises have likely peaked: We can likely anticipate some rate cuts from the RBA in September 2024 which will boost economic growth in late 2024 and into 2025.

Stay the Course!

Staying the course isn’t easy for investors, especially when there’s so much happening in the world.

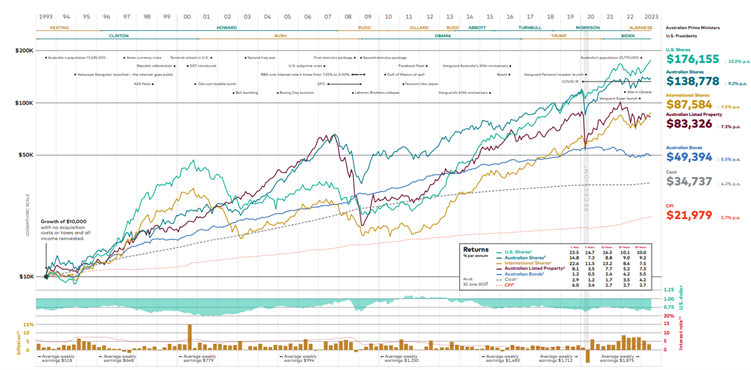

Short-term market events tend to grab headlines, but for investors, it’s the long-term trend you should focus on.

Each asset class has experienced years of best performance and worst performance, with no clear pattern, therefore making it impossible to determine which asset class will be next year’s winner. This demonstrates the importance of having a diversified mix of investments across multiple asset classes to smooth out returns over time.

Historical market returns show that those who ignore the emotional swirl of short-term market conditions and focus on the long-term are rewarded for their patience and discipline. That’s why staying the course is such a timeless lesson.

We hope this financial review of 2023 was helpful.

*The above table shows the Growth of $10,000 with no acquisition costs or taxes and all income reinvested from July 1993- June 20232

Lastly, we know that investing is no easy exercise – let the professionals handle your retirement nest egg for you in 2024!

Book a call back request by clicking here!

Phoenix Advisory Group will be by your side every step of the way in 2024!